florida estate tax rate

As mentioned Florida does not have a separate inheritance death tax. The top estate tax rate is 16 percent exemption threshold.

Does Florida Have An Inheritance Tax Alper Law

Florida Estate Taxes.

. There is also an average of 105 percent local tax added onto transactions giving the state its 705. Federal Estate Tax. No estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. 097 of home value.

There is no inheritance tax or estate tax in Florida. The federal government however imposes an estate tax that applies to all United. There are also special tax districts such as schools and water management districts that have.

Previously federal law allowed a credit for state death taxes on the federal estate tax return. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. The average property tax rate in Florida is 083.

If any of the. The federal government then changed the credit to a deduction for state estate. The Florida estate tax is tied directly to the state death tax credit provided in IRC.

Property taxes in Florida are implemented in millage rates. Florida Form F-706 and payment are due at the same time the federal estate tax is due. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

For a nationwide comparison of each states highest and lowest taxed counties see median property. The Florida estate tax is computed in FS. Florida sales tax rate is 6.

In 2022 Connecticut estate taxes will range from 116 to 12. Counties and cities can. A Florida Estate Gift Tax Attorney Can Help You.

There is no estate tax in the state of Florida since it was abolished after 2004. Even if you live in Florida. Property taxes in Florida are right in the middle of the pack nationwide with an average effective rate of 083.

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. The latest sales tax rates for cities in Florida FL state.

Florida real property tax rates are implemented in millage. Taxes on the federal return federal Form 706 is the amount of Florida estate tax due. Rates include state county and city taxes.

This was not always the case the current set-up is an outgrowth of the old system. Federal Estate Taxes. Each county sets its own tax rate.

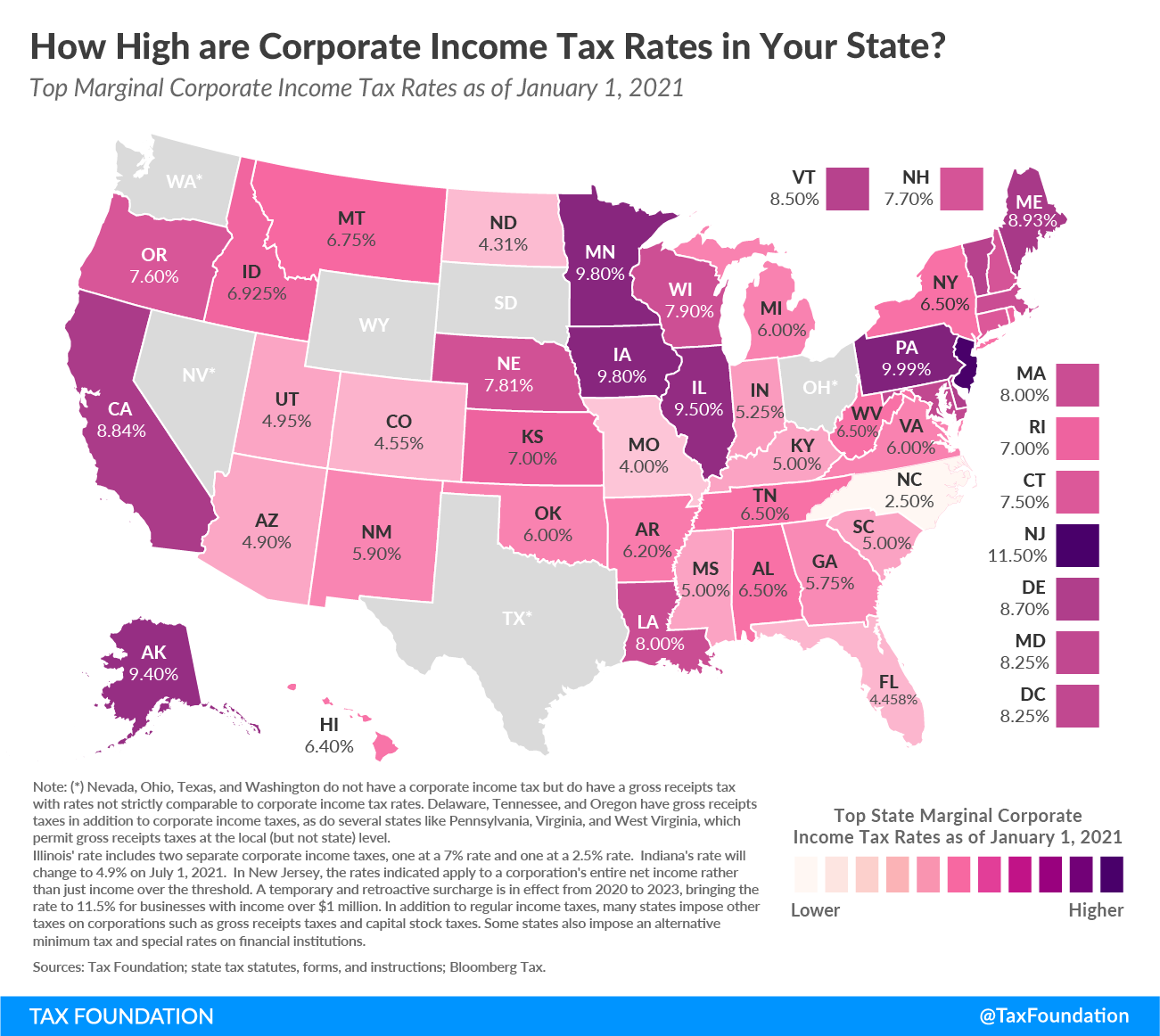

As a result of recent tax law changes only those who die in 2019 with. Tax law is complex at the best of times but because of its unified nature estate and gift tax questions can be even worse. Corporations that do business and earn income in.

A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. 19802 for resident decedents and in FS. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

Tax amount varies by county. Currently Florida doesnt collect its own Estate Taxes. Florida Counties With the LOWEST Median Property Taxes.

Florida Property Tax Rates. Florida does not have a state income tax. Florida Corporate Income Tax.

If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. 2020 rates included for use while preparing your income tax deduction. Groceries and prescription drugs are exempt from the Florida sales tax.

Florida has a sales tax rate of 6 percent.

![]()

Does Florida Have An Inheritance Tax Alper Law

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Florida Attorney For Federal Estate Taxes Karp Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eight Things You Need To Know About The Death Tax Before You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Is Tax Liability Calculated Common Tax Questions Answered

Does Florida Have An Inheritance Tax Alper Law

Florida Property Tax H R Block

Florida Real Estate Taxes What You Need To Know

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Florida Estate Tax Rules On Estate Inheritance Taxes

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How Is Tax Liability Calculated Common Tax Questions Answered

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)